Figures show the UK economy fell into a technical recession during the final three months of 2023. That means gross domestic product (GDP) dropped for two successive three-month periods. In response, the FTSE 100 hardly budged, so investors don’t seem surprised or concerned.

Looking at blue-chip stocks, I think one won’t be affected by a recession, either in the UK or elsewhere. Here’s why I’d still buy it, despite its meteoric rise over the past few years.

Up 156%

The stock I’m talking about is FTSE 100 defence giant BAE Systems (LSE: BA.). Rising military budgets in response to Russia’s shocking invasion of Ukraine have lit a fire under the share price.

Should you invest £1,000 in Marlowe Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Marlowe Plc made the list?

Up 156% in three years, only Rolls-Royce has performed better (+236%) across the Footsie.

During times of geopolitical tension or conflict (like today), governments will prioritise defence spending, regardless of wider economic conditions.

BAE’s customers are mainly national governments and organisations, which means the defence contracts it signs to build military equipment are long-term and unlikely to be cancelled.

This gives the company a great degree of visibility into future revenues. As of June 2023, it had a record order backlog of £66.2bn.

NATO spending is likely to increase further

On 10 February, presidential candidate Donald Trump said he would “not protect” any NATO member that had failed to meet the agreed 2% of GDP spend on defence.

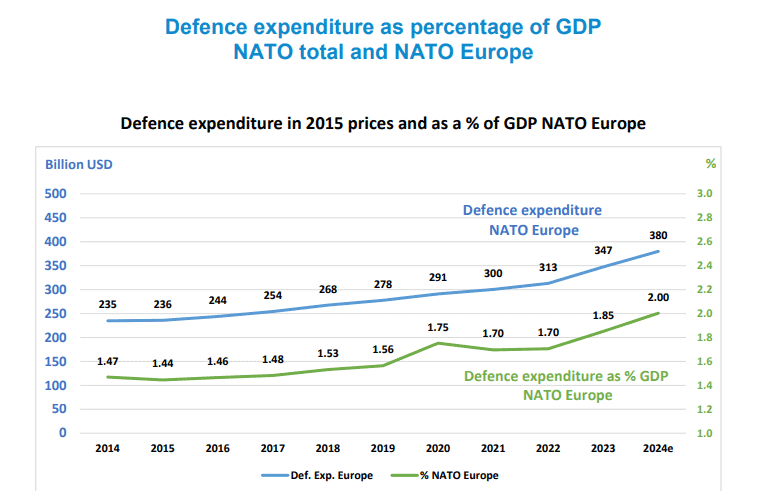

This prompted Secretary General of NATO Jens Stoltenberg to release the alliance’s latest defence spending figures, which show an unprecedented increase.

In 2024, NATO members in Europe will invest a combined total of $380bn on defence.

Stoltenberg said: “For the first time, this amounts to 2% of their combined GDP…European Allies are spending more. However, some Allies still have a ways to go. Because we agreed at the Vilnius Summit that all Allies should invest 2%, and that 2% is a minimum.”

Given that some countries “still have a ways to go” and “2% is a minimum”, this suggests strongly that European defence spending is going to increase further in the years ahead.

Indeed, Germany confirmed it would now have the “highest defence budget” in Europe and would maintain the 2% target “in the decades to come”.

All this spending over “decades” — in Europe and around the globe — provides an attractive long-term opportunity for BAE Systems. A UK recession is unlikely to have any impact on this.

I’d still invest

Now, the stock is trading on a price-to-earnings (P/E) ratio of 19.5. This is higher than its historical average and the FTSE 100’s P/E of around 11.

Naturally, this reflects the market’s expectation for stronger growth. But it could present risk if, say, there was a shortfall in profits or management offers cautious guidance.

After all, it’s possible the firm may struggle to increase capacity fast enough to meet demand. There’s already a well-documented engineering skills shortage in the UK.

On balance, though, I’d still buy the stock if I didn’t own it already. At the height of the Cold War, major governments spent around 6% of GDP on defence. In 2023, this military spending amounted to 2%.

If we’ve sadly entered Cold War 2, then I think BAE’s order backlog — and share price — could carry on rising.